Letter of Credit (L/C) is a document (electrical or certificate) in which the issuing bank of the L/C undertakes to pay the beneficiary if they present in accordance with the terms and conditions of the L/C, with the applicable terms of UCP 600 and international standard banking practices 681 ICC.

A commercial letter of credit forms on the basis of the underlying contract, but once issued, it is completely independent of the underlying contract. This is an important feature of L/C. The nature of the L/C is very strictly regulated in the UCP 600 2007 ICC: “In essence, L/Cs are separate transactions from sales contracts or other contracts that may or may not be so. on the basis of the L/C and the banks are not involved in or bound by such contracts, even if there is any reference to such contracts in the L/C.

Main contents of L/C

L/C number, place and issue date

All L/C must have its own number. The effect of the number is to exchange documents and telegrams related to the implementation of L/C.

The place of issue of L/C is where the bank issuing the L/C writes a commitment to pay the beneficiary. This location is significant in choosing a dispute resolution law.

The date of issuance of L/C is the start date of the commitment of the L/C issuing bank to the L/C beneficiary, the starting date of the L/C’s validity period and the basis for the L/C to be issued. The exporter checks whether the importer performs the opening of the L/C on time as specified in the contract.

Names and addresses of persons related to L/C

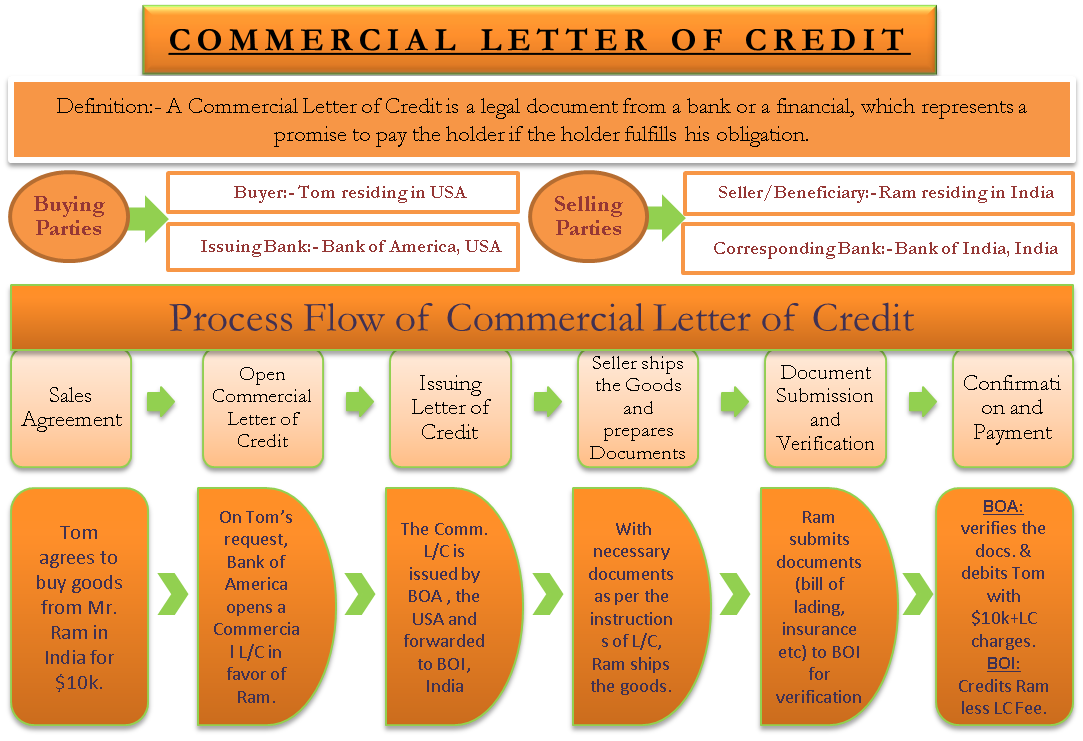

Those involved in L/C can be divided into two categories: merchants and banks. Traders include: importer (person who requests to open L/C), exporter (beneficiary of L/C). Banks participating in documentary credit include L/C issuing bank, advising bank, paying bank, confirming bank.

Amount of letter of credit

The amount of L/C is both written in numbers, written in words and agreed with each other. A letter of credit with a numerical and verbal amount that contradicts each other cannot be accepted.

The name of the currency must be clear. The same name is called the dollar, but in the world there are many different types of dollars such as the US dollar, the Australian dollar, the Canadian dollar, the Hong Kong dollar, etc. To avoid confusion, the money symbol should be used. ISO currency.

The amount should be avoided as an absolute number. Once the value of goods delivered does not match the value on the L/C, it is difficult to be paid, because the bank will give the reason that the documents do not match the terms and conditions stated in the letter of credit. The best way to record the amount is to include a limited amount that can be reached by the exporter whether the goods are delivered whole or in bulk. For example: “for a sum or sums not exceeding a total of X USD” (an amount not exceeding the total amount of X US dollars) or enter a difference limit more than or less than X% of the total amount that the exporter reserves the right to present payment documents such as: “For an amount of X USD more and less X%)

According to the 2007 Uniform Documentary Credits Rules and Practices 600 2007, the words “about”, “circa” or similar words are used to indicate the extent to which the amount of L. /C should be interpreted as allowing no more than 10% of the total amount.

In addition, the rule also stipulates that “unless the L/C stipulates that the quantity of goods delivered must not be less, a tolerance within 5% or less is allowed, provided that the total payment is always must not exceed the amount of L/C. This tolerance shall not be specified when the L/C specifies the quantity in either the stated bales or packages or in tin.

Validity period, payment term and delivery term stated in the L/C

- The term of validity of the L/C is the period within which the issuing bank undertakes to pay the beneficiary, if the beneficiary presents documents within that period and in accordance with the provisions of the L/C. The validity period of the L/C starts from the date of issue (date of issue) to the expiry date of the L/C (expiry date).

- Date of payment is the time to pay immediately or pay later. This is completely dependent on the terms of the contract. If the claim is made by bill of exchange, the time for payment shall be specified in the request for drawing of the draft. The payment term may be within the validity period of the L/C, if payment is made immediately, or it may be outside the validity period of the L/C, if the payment is due. But it is important that term drafts must be presented for acceptance within the validity period of the L/C.

- Delivery date (Shipment date) is also stated in the L/C and because of the contract of sale, the term of delivery is closely related to the validity period of the L/C.

Contents about goods

Such as product name, quantity, weight, price, quality specifications, packaging, markings, … are recorded in the letter of credit. However, for goods with complicated quality specifications and long expressions, they are not recorded in the L/C issued by electricity, but issued by attached mail.

Contents about transportation, delivery of goods

Such terms of delivery basis (FOB, CIF, CFR), place of dispatch and place of delivery, manner of carriage and delivery in whole or in part, transshipment or direct, etc. are also included in the credit. .

Documents that the beneficiary must present

The document specified in the L/C is a proof of the exporter that the delivery obligation has been fulfilled and that the provisions of the L/C have been fulfilled, so the bank issuing the L/C must rely on it. to proceed to pay the exporter, if the documents comply with the terms and conditions specified in the L/C.

Regarding documents, the L/C issuing bank usually requires the L/C beneficiary to satisfy the following conditions:

- Types of documents that L/C beneficiaries must present based on the minimum number of documents specified in the contract, the importer shall specify the types of documents that the exporter must present.

- Number of originals and copies of each type.

- Ask how to draw each type of document.

For example:

- The bill of exchange is drawn against whom? Time to pay now or pay later? Claim all or part of the commercial invoice value.

- What type of bill of lading? By order or by name? Goods have been loaded on board (shipped on board) or received for shipment, is there a requirement for a perfect B/L (clean), B/L according to someone’s order or a named B/L? freight prepaid or freight to collect, is there a bill of lading under the charter party (Charter party B/L), is there a late arrival bill of lading (stale B/L).

- What type of C/O, who issued it?

Commitment to pay of the issuing bank L/C

This is the content of the commitment and binding responsibility of the L/C issuing bank. Commitment can be demonstrated through:

- Real commitment.

- Conditional engagement.

- Contingency commitment (reservation), i.e. the bank undertakes to pay only drafts of presentation on time provided that the presented documents are in accordance with the terms and conditions of the L/C, with applicable provisions of UCP 600 and with international standard banking practices 681 2007 ICC.

Other special terms

In addition to the above contents, when necessary, the L/C-issuing bank may add other contents, for example, it can refund by electricity (T/T reimbursement).

Signature of bank issuing L/C

L/C is essentially a civil contract, so the person signing it must also be a person with full behavioral capacity and legal capacity to enter into and perform a legal relationship. If the L/C is issued by mail, the signature on the L/C certificate must match the signature registered between the two banks issuing the L/C and the advising bank of the L/C in the agency agreement between the two banks. that bank. If the L/C is issued by telex, instead of the above signature, it is the keytest (electronic key), or SWIFT is the SWIFT BIC code of your bank.

Above is our consultancy about this issue. If you need more detailed advice and answers as well as how to access this service, please contact directly the Deputy Director of Sales: Lawyer Nhat Nam via hotline: 0912.35.65.75, 0912.35.53.53 or call the free legal consultation hotline 1900.6575 or send a service request via email: lienheluathongbang@gmail.com

Wishing you and your family good health, peace and success!

Best regards!